The company was founded in 1989 by PT Dwi Satrya Utama (“DSU”) under the name of PT Tifa Mutual Finance Corporation as one of the finance companies that provides leasing, consumer / productive financing and factoring financing services with an initial capital of Rp 5 billion. The company continued to develop its capital until 1996 as a Joint Venture company with the joining Singapore's Tan Chong Credit Pte Ltd (TCC), a subsidiary of Tan Chong Motor Group (TCMG) from Malaysia, as a shareholder of the Company with a composition of 48%.

The company changed its name to PT Tifa Finance in 2000 and continued to develop its network and business until 2011 establishing a Sharia Business Unit and offering its shares to the public through an Intial Public Offering (IPO) and listing its shares in the Indonesia Stock Exchange.

In 2012 the Company succeeded in recording total assets of Rp1 trillion and continued to expand the network by opening several representative offices in several regions of Indonesia and also innovating through diversifying financing activities through working capital financing. Until now, the Company has 6 (six) network offices i.e Jakarta, Semarang, Surabaya, Balikpapan, Pekanbaru and Makassar.

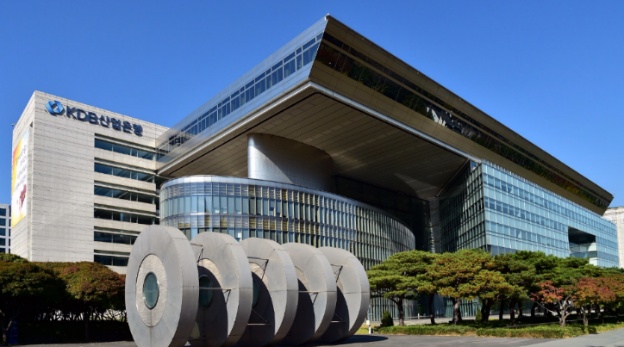

In year 2020 to be precise on 8 September 2020, the Company was officially acquired by The Korea Development Bank (“KDB”) which resulted in a change in the Company's share ownership structure to KDB of 80.65%, DSU of 15.00% and public of 4.35 %. The company also changed its name to PT KDB Tifa Finance Tbk, which has received approval from the authority in Indonesia. This acquisition is accompanied by a high commitment from KDB as the new Controlling Shareholder of the Company, of course, brings opportunity to the Company's future business development plans.

In line with the advancement of Information Technology, the Company continues to improve its Technology infrastructure to bring business closer to customer needs. Another thing that management does is always improve corporate culture based on capabilities and needs so that it can have a positive impact on the Company's performance optimally.

Strong commitment and synergistic steps from the Shareholders, Board of Commissioners, Directors and all employees are able to place and bring the Company to grow and develop sustainably over a period of more than 30 years in the national financing industry.

The Company has also proven that as a public company, the Company is able to improve its business performance along with demands from investors and stakeholders, the Company in this case can still prioritize the principles of Good Corporate Governance so that investor confidence can be maintained.

With KDB as the Company's Controlling Shareholder, it is hoped that it can further increase the Company’s value that is able to contribute optimally and play an active role in economic development and also become one of the leading Finance Company in Indonesia.